GI SPECIAL

5G25:

A Bankrupt Empire Hits The Wall:

"Today There Was Full-Blown Carnage"

"It’s Kind Of Like Catching A Falling Knife Right

Now"

"A Fairly Disorderly And Hysterical Move"

"By Spreading To Other Markets, The Subprime Mess

Is Driving Up Interest Rates For Borrowers Of All Sorts, Which Can Lead To A

Credit Crunch"

Comment On

The Articles Below: T

Contrary to absurd fantasies,

crises that interrupt the operation of capitalism don’t just go on day after

day at the same or increasing levels of panic and collapse. There will be weeks ahead when everything

seems quiet, and alarming news reports like the ones below fade away.

But as the contagion spreads

through more and more realms of production, distribution and accumulation, dramatic

upheavals become more frequent and severe; the interruption of the cycle of

production, distribution and accumulation becomes more pronounced; and it

becomes ever clearer to everyone in the society that a serious downturn has

arrived, with falling production, cuts in employment, and intense downward

pressure on wages.

Occasional violent shocks --

the bankruptcy of some major corporation or financial institution – grab

headline attention transiently, but play out against the background of a

slower, grinding attack on the standard of living of the working class as a

whole.

And who better suited to

preside over attacks on the standard of living of the American working class

and use the government to impose discipline upon it than the Democratic Party?

And who less suited to do so

than the Republican Party, too clearly identified with wealth and naked, crude

corporate greed? The relatively few

remaining political representatives of the American ruling class who still have

enough intelligence to perceive reality know that.

Meanwhile, within a year or

two, the want of ready money, called a credit crisis, will finally reach the

debt instruments of the Imperial government itself.

Those who today look for safety

from the violence shaking financial markets by buying U.S. treasury bonds and

notes, the famous "flight to quality" reporters love to point to today, will

come to regard those instruments as toxic waste, and wonder how they could ever

have been so foolish as to seek safety in the worthless paper of a bankrupt

Empire.

With that, the crisis matures

into a crisis of confidence in the government and the class of capitalists the

government was instituted, designed, and is operated to serve.

No, we have not been through

this before.

Never before.

Certainly not during Vietnam,

when the U.S. economy was still relatively stable, with substantial capital

reserves and deriving some income from the Empire, rather than seeing the

relative costs of the Empire pile up mountains of dollar denominated debt that

can never be repaid short of a violent depreciation of the dollar sufficient to

impoverish much of the population.

Never before in U.S. history

has a major crisis in the sphere of economic relations, expressing both massive

private and governmental bankruptcy, come at the same time as a failing

Imperial war draining off what little national capital remains.

Those who babble mindlessly

about a new world being possible had best appreciate that this indeed will be a

new world, and it will not be pretty.

One question, of some

importance, will be whether our troops will choose to serve the vast majority

of Americans who are the working class of the United States, or will choose to

serve the few on top who oppress, exploit, and torment us for their own benefit,

and who preside over the hopelessly antiquated economic relations that bring on

Imperial war abroad and economic disaster at home.

The answer to that question

will depend, more or less, perhaps decisively, on what links we have forged

with our class brothers and sisters in arms.

Now, not later.

Those who are willing to invest

substantial amounts of time in forging those links, and see no greater priority

in their lives, of necessity must find each other and begin the work.

A few who have made that

commitment can accomplish infinitely more acting together in an organized way

than an assortment more numerous who half-step their way lamely and hesitantly

along because they have other priorities.

It has been said there is a

world to win. There is also a world to

lose, a more dangerous possibility now than has been the case previously in

human history.

T

***************************************************

July 27, 2007 By MICHAEL

HUDSON, PETER A. MCKAY and AARON LUCCHETTI, Wall St. Journal

[Excerpts]

By bidding up stock prices all year,

investors were effectively betting the housing slowdown wouldn’t engulf the

broader economy. Yesterday, that confidence appeared to be shaken.

Stocks and corporate-bond markets tumbled

amid selling that was more widespread than during the three previous days of

triple-digit declines this month.

Along with risky bonds and

anything connected to the housing market, investors sold off stocks,

emerging-markets bonds and even high-quality corporate debt. The record trading

volume in stocks reflected rising anxiety.

Meanwhile, roughly 1,300, or nearly 17%, of

the around 7,800 stocks that trade on U.S. exchanges hit their lowest price of

the past 12 months.

To many investors, that made yesterday’s

selloff more ominous than other big declines this year. Sid Bakst, a senior

portfolio manager at investment firm Robeco Weiss, Peck & Greer, said the

steady drip of bad news on subprime-mortgage loans and the failure of some

leveraged buyouts to get long-term financing has made investors increasingly

nervous.

"As each day has gone by,

things have been leaking a bit more," Mr. Bakst said. "But today there was

full-blown carnage."

The Dow Jones Industrial Average sank 311.50

points, or 2.3%, to finish at 13473.57, after being down as much as 440 points

at midafternoon.

At the New York Stock Exchange,

trading curbs designed as safeguards against a crash remained in effect for

nearly all of yesterday’s trading session.

The selloff marked the biggest

three-day point drop for the Dow industrials in five years and wiped $105.9

billion off the average’s market value.

The broader Standard & Poor’s 500-stock

index slid 35.43 points, or 2.3%, to 1482.66, leaving it up 4.5% on the year.

The technology-focused Nasdaq Composite Index shed 48.83 points, or 1.8%, to

2599.34, and was up 7.6% on the year.

Yesterday’s volume on the nation’s three

major stock exchanges totaled 10.59 billion shares, up 34% from the previous

record, which was set earlier this year.

When volume is high, investors take big market moves more seriously.

The moves in the stock and bond markets, and

discouraging news about home sales and orders for capital equipment, led the

federal-funds futures markets -- where traders can bet on the Federal Reserve’s

next move -- to conclude that the central bank is now much more likely to cut

interest rates sometime this year.

Yesterday, investors sold off

stocks whose performance is tied to the ups and downs of the economy, like

energy companies, industrials and basic-materials companies, a sign investors

now think the economy will slow down. Those sectors were among the market’s

leaders this year.

Energy stocks, which were up

25% on the year before yesterday, led the way down after ExxonMobil Corp.

reported weaker-than-expected earnings. The energy sector had accounted for

roughly a third of the stock market’s earnings growth over the past two years,

meaning high oil prices actually had a positive impact on stocks.

But now energy prices, which have flirted

with new highs recently, are clearly a drag on the market.

The meltdown in the

subprime-mortgage market was clearly the factor that set off the cascade of

declines.

Investors fears have been

heightened by the sheer complexity of collateralized-debt obligations and other

structured finance vehicles, which makes it difficult for investors to judge

just how bad conditions are in the subprime sector, said Arthur Tetyevsky,

chief U.S. credit strategist at HSBC.

"Now it’s a much broader, much

more nebulous, much more intimidating issue for the market. And that’s adding to the duress that we’ve

seen in the market," Mr. Tetyevsky said.

By spreading to other markets,

the subprime mess is driving up interest rates for borrowers of all sorts,

which can lead to a credit crunch.

Many bearish observers thought the housing

slump might cause an economic slowdown by cutting into consumer spending, which

accounts for about two-thirds of the U.S. economy.

Consumer spending has held up reasonably

well, however, and now worries about the economy are focused on whether tighter

credit will undermine companies’ ability to borrow money so they can expand and

keep boosting their stock values.

The impact of tighter credit is

already apparent in the market for high-grade debt.

Yesterday, for example, Tyco

Electronics Ltd. pulled a $1.5 billion bond deal "due to unfavorable conditions

in the debt markets," the company said.

Selling bonds for a company

like Tyco, which has put its past scandals behind it, is normally a routine

affair.

As another example, Mr. Tetyevsky pointed to

the price action on a $1.5 billion bundle of 30-year bonds issued two weeks ago

by Lehman Brothers Holdings Inc.

By yesterday the quoted yield on those bonds

was roughly 2.4 points above the yield on 30-year Treasurys, widening from a

spread of roughly 2.15 points on Wednesday and 1.7 points back on July 12.

That’s a big increase for the

investment-grade bond market and a sign that investors are nervous and want to

get paid more for risking their money, even on bonds that are considered to

have a very low chance of default.

Some analysts said the credit market, which

had rallied strongly for several years, was due for a downturn. RBC Capital Markets fixed-income strategist

T.J. Marta said the high-grade-bond market’s move may simply be a symptom of

the air being let out of a credit bubble that had gotten too big.

"But the concern is that this

is a fairly disorderly and hysterical move, and that always carries the risk

that you hit a tipping point where things get out of control," Mr. Marta said.

Juggling his phone on the floor of the New

York Stock Exchange, broker Steven Grasso weighed in on a stock market where

investors’ fear has replaced greed as the most-prominent emotion.

The bond market "is a huge concern,"

said Mr. Grasso. "It’s been overhanging the market. New companies keep getting lumped into what’s

happening to subprime....People thought it would be a handful of companies, but

we’re seeing a marketwide impact."

Mr. Grasso said many companies’ borrowing

costs will go higher, lowering their earnings.

Until recently, emerging-market bonds had

largely weathered the turmoil in the U.S. and European credit markets. That’s a

testament to the strong economic fundamentals and financial stability of many

emerging economies. But, in another sign

of the disquiet in the markets, Russian energy giant OAO Gazprom abruptly

postponed a bond offering planned for yesterday.

"It’s kind of like catching a

falling knife right now," said Edwin Gutierrez, an emerging-market portfolio

manager at Aberdeen Asset Managers in London, of yesterday’s trading. "I wouldn’t be in a hurry to add risk."

U.S. investors awoke to overnight selling in

key Asian and European markets. In addition, the Australian asset-management

firm Absolute Capital announced that it was halting withdrawals from two funds

with about $200 million in assets invested in credit instruments, including

CDOs.

As the morning progressed, the

Commerce Department released data showing that new-home sales in the U.S. fell

6.6% in June -- more than quadruple the decline expected by economists in a

survey by Dow Jones Newswires.

The government also announced a

smaller-than-expected rise of 1.4% in June orders for big-ticket items known as

durable goods.

But mutual-fund investors have picked up

their selling as volatility has increased recently, according to TrimTabs

Investment Research.

MORE:

"There Is A Full Blown Liquidity Crisis At Hand In

World Financial Markets"

"Right Now, Virtually All Sources Of Liquidity Are

Drying Up Faster Than Anyone Would Have Thought"

"The Speed Which This Liquidity Crisis Is Emerging

Is Amazing Many"

Jul 27 2007 By Chris Laird, Prudent

Squirrel.com [Excerpt]

For the last several years, corporate

buyouts, corporate stock buy backs and such, the Yen carry trade, and the

mortgage derivatives markets have added tremendous liquidity to world financial

markets. In tandem with this, the market

analysts came to view a 'world stock bull’ emerging, and even the most

conservative market bears started to get into this world stock bull theme in

their writings.

The total amount of these sources of

financing and liquidity in the last 2 years is over $5 trillion, and has been

one of the major supports for stock markets.

All of a sudden, these sources

of liquidity are vanishing so fast, that market experts are amazed.

This all came together in about 3 or 4 weeks

after the Bear Stearns mortgage derivatives mess revealed how illiquid

structured finance (derivatives in mortgages and such) can become –

instantaneously.

After that, investors started

to flee from billions of dollars value of structured finance offerings in the

last several weeks, and in the blink of an eye, almost the entire derivatives

financing universe lost liquidity across the board.

This is a prime cause of the latest world

stock crashes.

Right now, virtually all

sources of liquidity are drying up faster than anyone would have thought.

Or, put another way, with corporate buy outs

and stock buybacks at over $1 trillion in the last year alone – that is now

almost gone as support for the markets.

Investment banks such as Morgan and Goldman have had to park about 40

huge deals planned this year, as they have not been able to sell of the bonds

and financing for these deals.

This picture emerged in only about 3 weeks.

Continuing, the now well known debacle with

mortgage derivatives – structured finance packaging risky mortgages into so

called AAA rated tranches – have led to financial crises at Bear Stearns,

Italease, killed deals with Morgan, and Goldman and others, and caused that

sector to lose liquidity to zero basically, in a mere two or three weeks after

the problems with Bears two now worthless hedge funds emerged.

Now, the almost the entire mortgage

derivative universe is tanking – and huge margin calls by banks to counter

parties are happening- and no one wants to buy.

Then, the long threatening

unwinding of the Yen carry trade is afoot, the Yen strengthening significantly

now for two weeks, and as that continued apace, world stock markets finally

started to fall apart – or crash – this week.

Lots of cheap Yen are borrowed at about 1%

and invested in every financial market imaginable. As the Yen rises, investors have to sell out

stocks and whatever, and then pay back Yen at higher exchange rates – a sure

loser.

This effect is magnified by a factor of ten

by hedge funds who use 10 to 1 or more leverage.

And the list of liquidity

drying up goes on, but, only a few weeks after the Bear Stearns CDO (mortgage

derivative mess) showed that no one wanted to buy CDOs any more, that rumbled

through credit markets, and now, as one trader said, 'there is a full blown

liquidity crisis at hand in world financial markets’.

This is not just about CDOs, but has now

scared almost the entire structured finance (derivatives) universe because it

showed how illiquid they can become- basically instantly illiquid.

And, as, in the case of Bear, or Italease,

bankers have to call in loans from counterparties who hold their structured

finance derivatives, and find that their counterparties cannot fulfill the 'margin’

calls in many cases – read as a liquidity crisis.

Then, as this all is occurring,

world financial markets are crashing, as the easy liquidity for corporate

buyouts and buybacks, and mortgage financing, all of a sudden vanishes in only

about 3 weeks.

The speed which this liquidity

crisis is emerging is amazing many.

MORE:

"What Are, Generally Speaking, The Characteristics

Of A Revolutionary Situation?"

Comment: T

Whatever you may think of the

politics of this writer, he was rather skilled at figuring out when a

revolutionary situation was present:

He describes the essential

ingredients:

1. A ruling class split and at war within itself

about what to do: "a crack through which the dissatisfaction and the revolt of

the oppressed classes burst forth"

2. An economic crisis hammering the working

class

3. A war that breaks the passivity of "peacetime"

politics.

4. He might have added, had this been written

later, a rulings class so blind and stupid it can’t conceive of a whole

population rising in revolution against it, and an army happy to join the mass

movement from below.

**************************************************

1915, Excerpts from Collapse Of The Second

International & IMPERIALISM AND SOCIALISM IN ITALY, Kommunist, Nos. 1.2,

1915, By V. I. Ulyanov. [The writer used

the pen name "Lenin" to keep the government from terrorizing his family. Excerpts]

For a Marxist there is no doubt that a

revolution is impossible without a revolutionary situation; furthermore, we

know that not every revolutionary situation leads to revolution.

What are, generally speaking,

the characteristics of a revolutionary situation?

We can hardly be mistaken when

we indicate the following three outstanding signs:

(1) it is impossible for the

ruling classes to maintain their power unchanged; there is a crisis "higher up,"

taking one form or another; there is a crisis in the policy of the ruling

class; as a result, there appears a crack through which the dissatisfaction and

the revolt of the oppressed classes burst forth.

If a revolution is to take

place …. it is necessary that "one is incapable up above" to continue in the

old way;

(2) the wants and sufferings of the oppressed

classes become more acute than usual;

(3) in consequence of the above

causes, there is a considerable increase in the activity of the masses who in "peace

time" allow themselves to be robbed without protest, but in stormy times are

drawn both by the circumstances of the crises and by the "higher-ups"

themselves into independent historic action.

Without these objective

changes, which are independent not only of the will of separate groups and

parties but even of separate classes, a revolution, as a rule, is impossible.

The co-existence of all these

objective changes is called a revolutionary situation.

This situation existed in 1905 in Russia and

in all the periods of revolution in the West, but it also existed in the

seventh decade of the last century in Germany; it existed in 1859,1861 and in

1879-1880 in Russia, though there was no revolution in these latter instances.

Why?

Because a revolution emerges

not out of every revolutionary situation, but out of such situations where, to

the above-mentioned objective changes, subjective ones are added, namely, the

ability of the revolutionary classes to carry out revolutionary mass actions

strong enough to break (or to undermine) the old government, it being the rule

that never, not even in a period of crises, does a government "fall" of itself

without being "helped to fall."

***************************************

"Much Has Been Left In The World That Must Be

Destroyed By Fire And Iron For The Liberation Of The Working Class"

Take the present army. It is one of the good examples of

organisation. This organisation is good

only because it is flexible; at the same time it knows how to give to millions

of people one uniform will.

Today these millions are in their homes in

various parts of the country. Tomorrow a

call for mobilization is issued, and they gather at the appointed centres.

Today they lie in the trenches, sometimes for months at a stretch; tomorrow

they are led into battle in another formation.

Today they perform marvels, hiding themselves

from bullets and shrapnel; tomorrow they do marvels in open combat. Today their

advance detachments place mines under the ground; tomorrow they move dozens of

miles according to the advice of flyers above ground.

We call it organisation when, in the pursuit

of one aim, animated by one will, millions change the forms of their

intercourse and their actions, change the place and the method of their

activities, change the weapons and armaments in accordance with changing

conditions and the vicissitudes of the struggle.

The same holds true about the fight of the

working class against the bourgeoisie.

Today there is no revolutionary

situation apparent; there are no such conditions as would cause a ferment among

the masses or heighten their activities; today you are given an election ballot

- take it.

Understand how to organise for it, to hit

your enemies with it, and not to place men in soft parliamentary berths who

cling to their seat in fear of prison.

Tomorrow you are deprived of

the election ballot, you are given a rifle and a splendid machine gun equipped

according to the last word of machine technique: take this weapon of death and

destruction, do not listen to the sentimental whiners who are afraid of war.

Much has been left in the world

that must be destroyed by fire and iron for the liberation of the working

class.

And if bitterness and despair

grow in the masses, if a revolutionary situation is at hand, prepare to

organise new organisations and utilize these so useful weapons of death and destruction

against your own government and your bourgeoisie. .

This is not easy, to be sure.

It will demand difficult preparatory

activities. It will demand grave

sacrifices.

This is a new species of organisation and

struggle that one must learn, and learning is never done without errors and

defeats.

The relation of this species of

class struggle to participation in elections is the same as storming a fortress

is to maneuvering, marching, or lying in the trenches.

This species of struggle is

placed on the order of the day in history very infrequently, but, its

significance and its consequences are felt for decades.

Single days when such methods

can and must be put on the programme of struggle are equal to scores of years

of other historic epochs.

**************************

The question has been put

squarely, and one cannot fail to recognise that the European War has been of

enormous use for humanity in that it actually has placed the question squarely

before hundreds of millions of people of various nationalities: either defend,

with, rifle or pen, directly or indirectly, in whatever form it may he, the

great-nation and national privileges, in general, as well as the prerogative or

the pretensions of "our" bourgeoisie, that is to say, either be its adherent

and lackey, or utilize every struggle, particularly the clash of arms for

great-nation privileges, to unmask and overthrow every government, in the first

place our own, by means of the revolutionary action of an internationally

united proletariat.

There is no middle road; in

other words, the attempt to take a middle position means, in reality, covertly

to join the imperialist bourgeoisie.

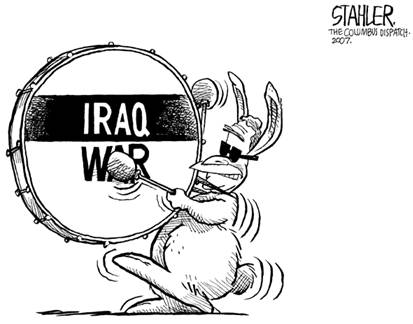

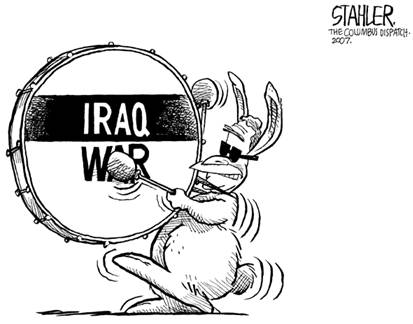

IRAQ WAR REPORTS

U.S. Soldier Killed In Diyala

July 27, 2007 Public Affairs Office, Camp

Victory Release No 20072607-06

TIKRIT, Iraq — One Task Force Lightning

Soldier died as a result of injuries sustained from an explosion near his

vehicle while conducting operations in Diyala province, Thursday.

Everett Soldier Who Joined Army For His Daughter Killed

In Iraq

July 27, 2007 By ROB PIERCY, KING 5 News

EVERETT, Wash. — The family of Army Private

Michael Baloga, who grew up in Everett, says he has been killed in Iraq.

"He was probably my best friend," says Baloga’s

sister, Leah Valade. "He was the last person I would expect or want anything

bad to happen to. I was really upset because I know the risks involved with him

going over there, but I was really proud he took the initiative to do something

he wanted to do with his life."

After graduating from Sequoia High School in

Everett, Baloga worked construction.

Then his daughter, Isis, came along. Wanting

to give her more than he could at the time, he joined the Army.

On his Myspace page, Baloga wrote that two of

his goals in life were to watch his daughter graduate and give his daughter

away at her wedding.

"The whole reason he went into it was pretty

much for his daughter," said Valade. Baloga was a cavalry scout at Fort Hood,

Texas. He shipped out just about a year ago to Camp Normandy in Northern Iraq.

Every few weeks, he’d send his family an

email update.

"Every time he’d come back from a mission, he’d

tell me, 'I’m back, I’m okay, you can stop worrying now," said Valade.

Exactly what happened Thursday that killed

Baloga was not immediately clear. All Valade knows is that there was some sort

of explosion and her brother died. Not

just a brother, but a friend.

"Make sure you tell the people you love, that

you love them everyday, because you never know when they’re going to be gone,"

said Valade.

The Baloga family is gathering in Idaho,

where Baloga’s father lives. No funeral arrangements have been made.

Army Nurse From Puerto Rico Killed In Iraq

Jul 16, 2007 By Michael Melia, The Associated

Press

SAN JUAN, Puerto Rico — A Puerto Rican

soldier killed in a mortar attack in Baghdad’s Green Zone was the first Army

nurse to die from combat-related injuries in the Iraq war, a Pentagon

spokeswoman said Friday.

Army Capt. Maria Ines Ortiz, 40, who had been

serving in Iraq since September, was caring for wounded Iraqis at a hospital

inside the fortified district that also hosts the U.S. Embassy and Iraq’s

parliament, her family said.

"She touched everyone’s lives and everything

about her was positive," her fiance, Juan Casiano, said from her mother’s home

in Pennsauken, N.J. "She always carried a smile."

[ Printable version

] | [ Send it to a friend ]

[ Contatto/Contact ] | [ Home Page ] | [Tutte le notizie/All news ]

|